In 2020, Asbury First United Methodist Church celebrated its bicentennial, marking two hundred years of faithful service to God and neighbor. None of us were here for the beginning and, by God’s grace, none of us will be here for the end. We are so grateful for the legacy of those who have gone before, and we choose today to accept our part in the story, making a way for those who come after.

Our prayer is that our decisions will ensure a solid foundation for Asbury First as we embark on the next two hundred years and beyond. We walk humbly and tread lightly, but recognize the gift of this moment—to celebrate our past, assess our present, and plan for our future.

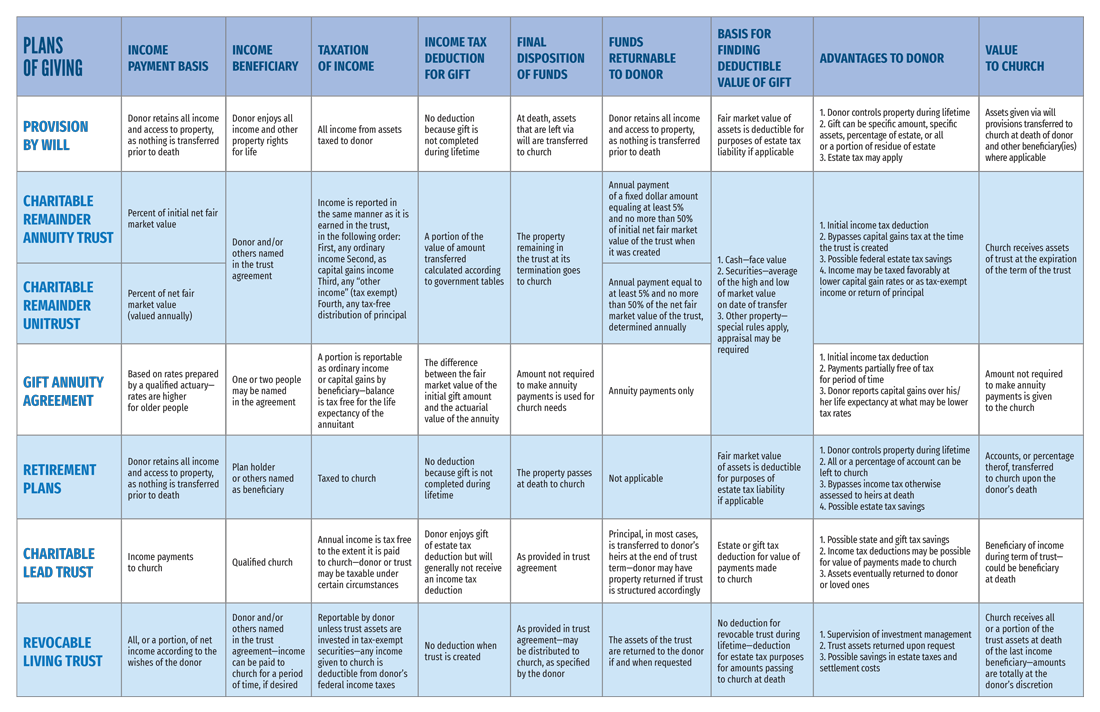

As you consider your part in the legacy at Asbury First, you may find yourself weighing how you plan to include Asbury First in your estate plans. The following information and chart provides a summary of the most popular ways to structure a planned gift.

Each donor’s circumstances are different, and tax and other financial benefits may vary over time. Check for the most recent state and federal laws and regulations for the most recent information. Members of our staff (our Senior Minister and Church Administrator) and members of the Giving Team are available to meet with you and discuss any questions you may have. We would be happy to go through options with you and help you prepare to meet with the proper advisor and/or attorney.

Once you have decided on a planned gift of some kind, you may choose to complete a Disclosure Form and submit it to the Senior Minister and/or the Church Administrator. This ensures we have a record of your plans and can be prepared when the time comes for Asbury First to receive your gift. Disclosure Forms are available at the church office or by contacting Deb Bullock-Smith at dbullocksmith@asburyfirst.org or 585-271-1050 x117.

Click here for Legacy Giving Chart Click here for Plans for Legacy Giving Click here to view the Living Legacy Introductory Brochure Click here to view the Living Legacy Larger Brochure

This information is to provide general gift, estate, and financial planning information. It is not intended as a legal, accounting, or other professional advice. For assistance in planning charitable gifts with tax and other financial implications, please seek out an appropriate advisor or attorney.

The following chart provides a summary of the most popular ways to structure a planned gift. These plans may be used to help provide for personal needs and those of loved ones while also giving current, capital, and/or endowment support to Asbury First. A number of gifts can be completed using plans that may already be in place for other purposes. Other options can be tailored in ways that provide income and other benefits, while helping minimize income, capital gains, as well as estate and gift taxes.

Cash, securities, real estate, or personal property can all be given to Asbury First through a well-planned will. A bequest can be stated simply as follows: “I give and bequeath to the trustees of Asbury First ___% of my total estate (or $___ or other property).” Such a provision creates an unrestricted bequest, which assures that your gift will be used where it is most needed at the time it is received. In addition to an unrestricted bequest, a gift by will may be designated for a specific program or purpose within the scope of our mission. When making provisions by will, it is important to use the church’s correct name and address.

Both of these plans are irrevocable trusts that feature income based on the value of the property donated. The annuity trust pays a fixed income based on the value of assets at the time the trust is created, while the unitrust provides a fluctuating income based on a fixed percentage of the trust’s annual value.

Through a charitable gift annuity, one can make a gift to Asbury First and receive fixed annual payments for life. Payment rates are based on the age(s) of payment recipient(s) when the gift is completed. Rates are generally higher for older persons. An income tax deduction is allowed for a portion for the amount transferred. For a period of time, based on life expectancy, only part of the payments will be taxed as income. If stocks or other property that have risen in value are given for a gift annuity that pays income to you and/or your spouse, a portion of the capital gain is never taxed, and the remainder may be gradually reported over a period of time. Also, if you and/or your spouse are the only payment beneficiaries, the amount used to fund a gift annuity is generally not subject to estate tax that might otherwise be due.

An employer-sponsored retirement plan and/or a private fund such as an Individual Retirement Account (IRA) may be used to make a planned gift. You can designate Asbury First as the final beneficiary of any remaining funds. This gift can be designated when the fund is first established, or it can be added later. The plan administrator will provide a change of beneficiary form upon request and you can indicate the amount you wish to allocate to Asbury First. Giving this way can help maximize estate and income tax savings for your loved ones. Special tax benefits are available to persons over the age of 70½ who wish to make gifts to Asbury First from an IRA.

A charitable lead trust can be created to provide income for charitable purposes for a designated period of time— ranging from 5 to more than 20 years. Through the use of this plan, it can be possible to transfer assets to heirs while paying little to no gift or estate tax.

Just as in the case of a gift by will, through the use of a revocable living trust you can provide for eventual gifts of real estate, cash or other properties, knowing that all or part of the assets may be returned upon request during your lifetime. The income from the trust during lifetime can be paid to the donor, another person, or Asbury First, as directed.

When stocks, bonds, mutual funds, real estate, and other appreciated assets are sold, tax is due on any capital gain. If the appreciated property has been held long-term (more than 12 months), and it is given to Asbury First, an income tax deduction is generally allowed, based on the current value of the property. It is usually best to donate property that would be subject to the highest amount of tax if sold.

Questions about Legacy Giving? Email Deb Bullock-Smith at dbullocksmith@asburyfirst.org, or call the church office at 585-271-1050 or email giving@asburyfirst.org.